Use Cases

HODLer Market can be used more than just lending and borrowing. Below are 8 scenarios where users can utilize the HODLer Market in different ways.

Token Lock-up

LP Token Lock-up

Salary Issuing

Auto Vesting

Airdrop Locked Tokens

Leveraged Long Position

Governance

Initial Loan Offering (ILO)

Token Lock-up

Following the Token Generation Event (TGE), new tokens are vested every certain period which generates high selling pressure. Finding a home for the upcoming liquidity seems more crucial than ever for projects. After all, as a project, the long-term goal is a loyal community.

This is when the DeFiner HODLer market comes into the picture. A project can utilize the lock-up function in the HODLer Market to encourage its community to HODL. The lock-up prevents high selling pressure and further prevents the token price drop. The HODLer Market effectively stops the death spiral and creates a healthy community.

On a sunny day, the community will feel satisfied as the token price goes up and they will help to promote the project due to the wealth effect. During a rainy day, the community has the option to borrow against the token locked instead of selling.

LP Token Lock-up

After TGE, the next step is to build a liquidity pool on DEX for token holders to trade. The best way to reward the liquidity providers is via an LP pool. However, there are mercenary liquidity providers who only come to the farm, withdraw and sell. When the protocol reduces or stops the token rewards, liquidity miners will immediately move to other protocols offering higher rewards leaving a dead community behind.

With the HODLer market, projects can create a locked pool for their LP tokens which means users will get their LP token after a certain period. Only users who are committed and target for the long run are willing to lock their LP. HODLer market efficiently helps projects filter out mercenary liquidity providers and build a strong community.

Salary Issuing

To create a strong bond between the project and team members, most token issuers choose to pay the team with a certain portion of their native token. However, some team members are risk-averse. Even if they want to hold the tokens, there are basic living expenses that need to be covered. These people tend to sell the tokens immediately upon receiving which is opposite to the original purpose of rewarding them with the project's native token.

With a HODLer market, projects can define a locking period for their native token when issuing tokens as a salary. Since the locked position can be used as collateral, team members can easily borrow against it. In this case, even risk-averse team members don't have to worry about running out of grocery money if they don't sell the tokens right away. They can hodl on without any pressure and count on a 10x or 100x return because of their hard work and contribution to the project.

Auto Vesting

One creative use case for the HODLer Market is to use it as a vesting tool for projects right after TGE.

If the vesting schedule is linear, the project can first issue a token to represent investors' position and then create a HODLer market using the about-to-issue token as a reward token and the position representation token as the base token. The project can vest the token by configuring the total amount of rewards that need to be issued based on the vesting schedule.

If the vesting schedule is based on an interval, it is even simpler with the HODLer Market. Projects can just deposit their about-to-issue token and configure a maturity date based on the schedule. The investors can claim the token after the maturity date.

Vesting with the HODLer Market also provides flexibility for investors. Not only can they get the token anytime they want with a fully transparent release schedule but also can transfer or sell their unvested token positions. Moreover, investors can borrow against their unvested position to unlock some liquidity.

Airdrop with Locked Tokens

Airdrop events are no strangers to crypto projects. It's all about customer acquisition. The cost of which should always be lower than the Lifetime Value of the customer itself.

While airdrop events are a good way for customer acquis, it's a double sword. Airdrops also attract mercenary stakes which creates the same issue as the mercenary liquidity miners. Projects are not gaining customers and yet losing money over airdrops campaigns. The negative effects outweighed the marketing effect.

The HODLer market can successfully solve this situation by providing the projects with two options. Option 1 is a direct airdrop with a lock-up period. The projects can utilize the lock-up function and directly airdrop through the HODLer Market. Projects can simply deposit their airdrop token into the HODLer market and configure the maturity date. In return, they will get position tokens and distribute these to airdrop participants. Participants can directly withdraw the airdrop tokens upon maturity dates. This helps the projects filter out the mercenary stakers since they are looking to make some quick bucks.

Option 2 is linear vested airdrop rewards. Projects can also choose to have their airdrop reward tokens linearly vested over a certain period. They can configure the market with their airdrop token as a reward token. Once they deposit the airdrop token into the HODLer Market, a position token will be generated. Airdrop participants can deposit the position token in the HODLer Market and receive the airdrop token.

By using the HODLer market, projects filter out the mercenary stakers since these people are only looking to make some quick bucks instead of long-term commitments. The real customers stay. The project's campaign money is well spent due to the real conversion and customer acquisition. This method creates a win-win situation for airdrops events.

Leveraged Long Position

For tokens right after TGE and just released for public trading, usually, there are few venues for their token holders to buy with leverage.

One of the creative ways that projects can do is to utilize the DeFiner HODLer market. Since token holders can borrow against the locked position, they can use the borrowed money to purchase more tokens in the secondary market and deposit the token once again to the HODLer market to earn more yield. The leveraged position encouraged the community to hodl ever more tokens.

As the trading volume and liquidity increase, projects can choose to increase the collateral factor which provides token holders even more leverage.

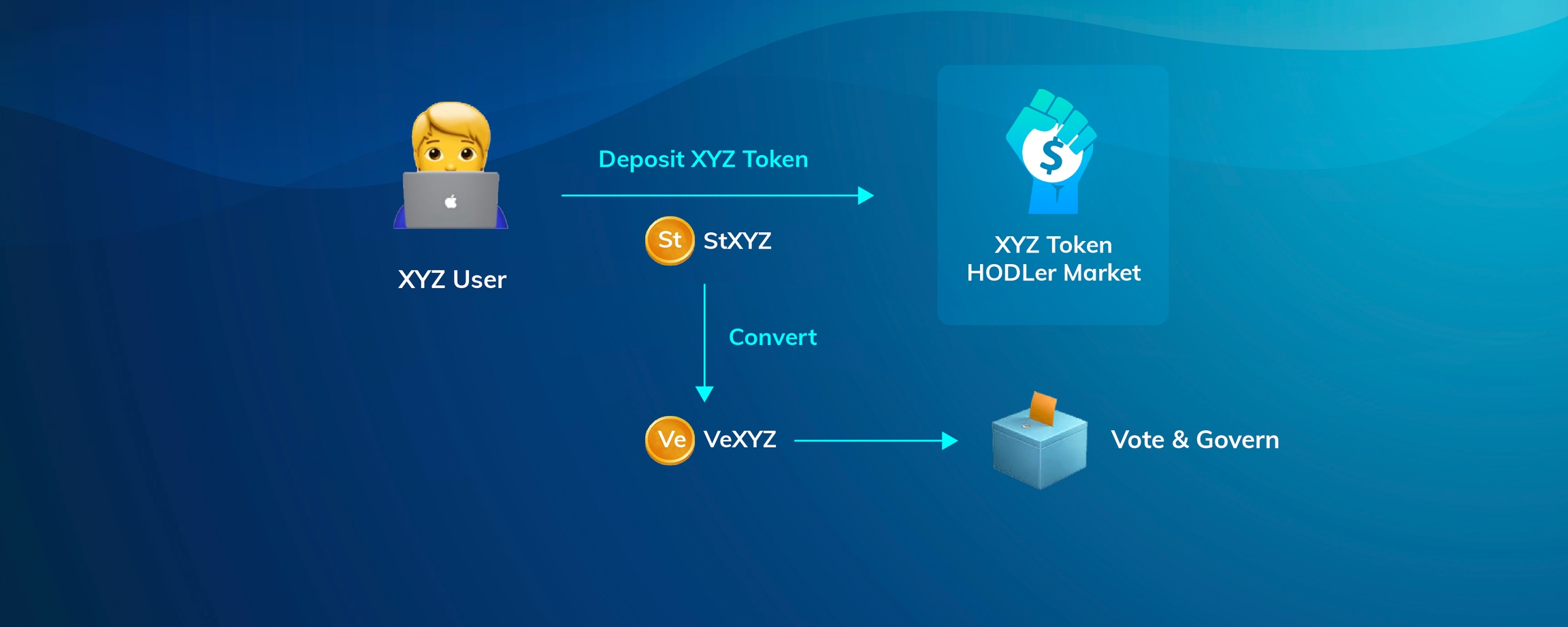

Governance

DAO or projects can utilize HODLer Market to generate governance tokens to further facilitate their own governance. Once the community starts to deposit and lock their token in the HODLer market, they will receive a staked token (stToken) to represent their positions. DeFiner also provides a tool to convert the stToken into a voting token (veToken). Based on the number of stToken and lock period, the community will get veToken. The community can use these veToken to participate in their own governance process.

The benefit of comparing the veToken is that it efficiently filters out the short-term token holders and grants the voting power to the long-term supporters. Those supporters are the true voice of the community since they are willing to lock up their tokens and grow with the project.

Initial Loan Offering (ILO)

People have high expectations during ICO and IDO. Whether it's private investors or public sales investors, for every penny they invested, they are looking for 100x, 1000x, or even more. Not reaching the desired rate will cause the spread of negative comments in the community.

The HODLer market gives the project an alternative. Instead of raising money from the token sale with high pressure and high expectations, projects can simply raise funds through debt. The project can deposit their unlaunched tokens with the specification of lock-up time and interest rate and borrow stablecoins against it.

With a more predictable rate and time, projects have better control of their token launching and market making. Also, this is a good way of gaining more retail investors through both the projects and DeFiner's community.

SDK

Projects spent a lot of time and effort on seamless and holistic user experience to keep the traffic on their site. While integration is good for the ecosystem, it can direct the traffic away.

With the HODLer Market, projects do not have to be concerned about driving traffic away as we provide detailed SDK and customizable widget functions. Projects can integrate the HODLer Market with their own UI since the HODLer smart contract is deployed on the blockchain with an open and transparent ABI. This function will save the project's time significantly which is specifically in favor of NFT, GameFi, and Metaverse projects since it is an easy token utility booster for them.

SDK Docs: https://docs.definer.org/definer-hodler-sdk

HODLer Market Demo Video

More on the HODLer Market

Learn more about HODLer Market: https://blog.definer.org/definer-hodler-market

Start to create a HODLer Market today: https://beta.definer.org

Last updated